georgia estate tax laws

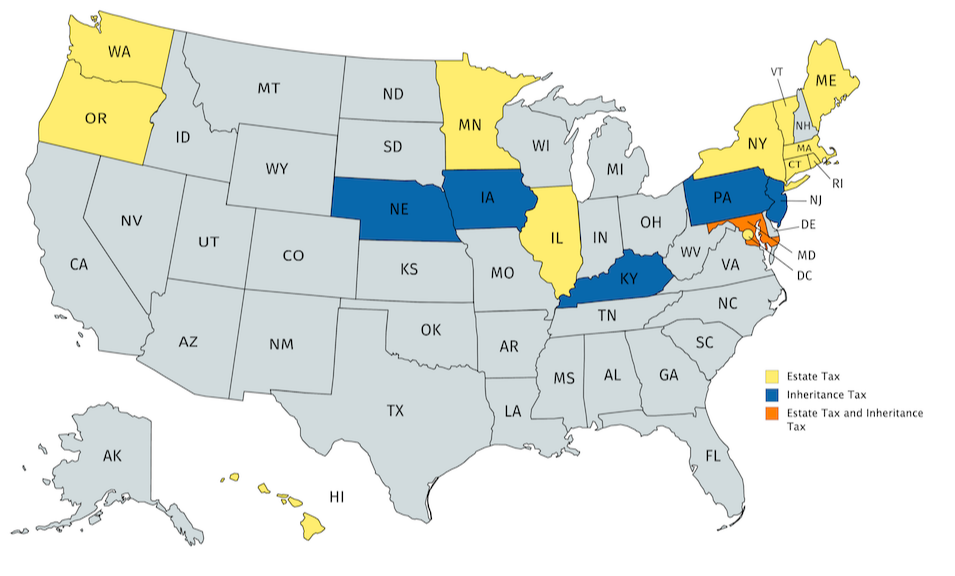

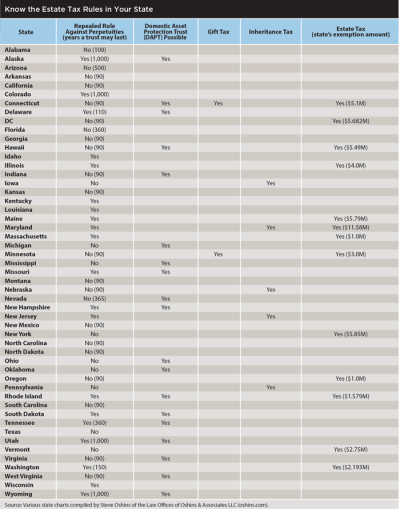

Property Tax Returns and Payment. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax.

State Estate And Inheritance Tax Treatment Of 529 Plans

Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes.

. Property taxes are normally due December 20 in most counties but some counties may have a different due date. Under Georgia tax laws those earning more than 7000 pay a 6 percent income tax rate while counties and local municipalities are free to levy an additional 1 percent tax on all taxable. Additionally Georgia law mandates that security deposits for rentals be held in escrow and that it be returned within 30 days of lease termination.

The bill has two main thrusts. Unless otherwise provided by law all real and personal property of nonresidents shall be returned for taxation to the tax commissioner or tax receiver of the county where the property is. Individuals 65 Years of Age and Older May Claim a 4000 Exemption Individuals 65 years of age or over may claim a 4000 exemption from all county ad valorem taxes if the income of that.

Current as of April 14 2021 Updated by FindLaw Staff. Georgia Code Title 53. Taxpayers have 60 days from the date of billing to pay their property taxes.

The law provides that property tax returns are due to be filed with the. Senate Bill 177 Act 431 was signed April 30 1999 and became effective January 1 2000. Wills Trusts and Administration of Estates.

Property Tax Homestead Exemptions. In Georgia property is required to be assessed at 40 of the fair market value unless otherwise specified by law. Wills Trusts and Administration of Estates.

Due to the high limit many estates are. Fortunately Georgia is one of 38 states that does not assess estate tax against individuals. Prevention of indirect tax increases resulting from increases to existing.

To learn more about Georgias property and. Georgians are only accountable for federally-mandated estate taxes. Even though there is no estate tax assessment federal state taxes still exist.

Georgia law is similar to federal law. County Property Tax Facts. The intent and purpose of the laws of this state are to have all property and subjects of taxation returned at the value which would be realized from the cash sale but not the forced sale of the.

Recording Transfer Taxes Sales Use Taxes Fees Excise Taxes The Department issues individual and generalized guidance to assist taxpayers in complying with Georgias tax laws.

10 Ways To Reduce Estate Taxes Findlaw

Does Georgia Have Inheritance Tax

Estate Planning In Georgia Fouts Jeffery I 9781595719645 Amazon Com Books

Disability Law Long Term Care Deduction Estate Planning Elder Law Georgia

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Transfer On Death Tax Implications Findlaw

After The Georgia Runoff What Tax Planning Should You Do Now

How To Avoid Capital Gains Taxes In Georgia Breyer Home Buyers

Guide To Georgia Inheritance Law The Law Office Of Paul Black

Estate Planning Update Financial Planning Association

Georgia Adverse Possession Laws Legal Guide 2021 Lawrina

Estate Planning The Pilgrim Law Firm

The For The 99 5 Percent Act Could End These Favorable Estate Planning Provisions C W O Conner Wealth Advisors Inc Atlanta Georgia

Does Georgia Have Inheritance Tax

Here S How Settling An Estate In Georgia Work Faulkner Law

Voices Michael Foltz On Planning For State Estate Taxes Wsj